Social Security Know How Program

Social Security can be complicated. Don’t worry, we can help. Let’s start with the fundamentals. You know Social Security provides income you can’t outlive. But is it enough income? It may replace only a portion of your income. Read on to enhance your Social Security know how.

Know How Social Security Pays

Most of Social Security payouts comprise of retirement and survivor benefits which possess unique characteristics:

- You can’t outlive them

- You can receive automatic cost of living adjustments

- You need not be an investment expert

For a program so important, it pays to know how it works and consider how you can maximize it.

Know How Qualification Works

In order to receive Social Security retirement benefits, a worker born in 1929 or later needs 40 credits.

The most a worker can earn in a calendar year is four credits.

Benefits are based on a worker’s highest 35 years of earnings indexed for inflation. Years with no earnings count as zero, thus lowering the average career earnings and the monthly retirement benefit.

Know How Retirement Benefits Work

Benefits are based on Full Retirement Age (FRA). For those born between 1943 through 1954, FRA is age 66 and 0 months. See the chart for other birth years. Starting benefits at any time other than FRA results in either a decrease or an increase in benefits.

| Year of Birth | Full Retirement Age |

|---|---|

| 1943-1954 | 66 |

| 1955 | 66 & 2 months |

| 1956 | 66 & 4 months |

| 1957 | 66 & 6 months |

| 1958 | 66 & 8 months |

| 1959 | 66 & 10 months |

| 1960 & later | 67 |

Retirement benefits are payable to a worker as early as age 62. A spouse can also receive benefits based on the worker's earnings history.

A spouse can receive up to 50% of the worker’s full retirement benefit, reduced if the spouse is less than full retirement age. The worker must have filed for benefits.

A divorced spouse can receive a benefit even if the ex-spouse is not retired. The divorced spouse must have been married at least 10 years, not have remarried and be at least age 62. The ex-spouse worker must also be at least 62 years of age. Benefits paid to a divorced spouse do not impact the benefits of an ex-spouse worker's current spouse.

Early retirement results in a permanent reduction in benefits from what would have been received at full retirement age.

If a worker files for early retirement, benefits will be reduced 5/9 of 1% each month for the first 36 months plus 5/12 of 1% for the remaining period until the worker reaches FRA. For a person with an FRA of 66, filing at age 62 results in a 25% permanent reduction in benefits.

If the spouse of a worker files for early spousal retirement benefits, the reduction is 25/36 of 1% for the first 36 months plus 5/12 of 1% for the remaining period until the spouse reaches FRA. A spouse with an FRA of 66 and filing for benefits at age 62 would receive 35% of the worker’s full retirement benefit.

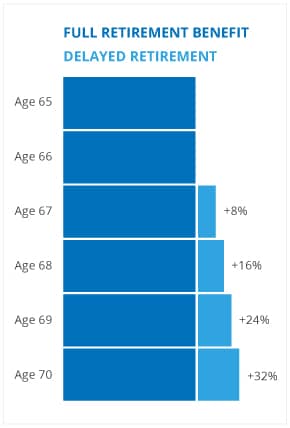

Delayed retirement increases monthly benefits. Benefits are increased on a monthly basis at a rate of 8% per year from FRA to age 70 (up to a maximum 32% increase over full retirement benefit).

Know How Survivor Benefits Work

Survivor benefits (when not caring for an eligible child) are payable as early as age 60 for a spouse. This is known as a widow’s or widower’s benefit.

To qualify for survivor benefits, a worker must have a minimum of 40 credits at the time of death if age 62 or older. The requirement decreases one by one each year to a minimum of six credits needed if age 28 or younger.

A surviving spouse can receive benefits as early as age 60 with a reduction for benefits received before the surviving spouse’s full retirement age. A surviving spouse will not receive survivor benefits if remarried before age 60. Remarriage at age 60 or later will not disqualify the surviving spouse from survivor benefits. A divorced spouse, married at least 10 years, must comply with the same rules. Benefits payable to a divorced spouse do not impact the benefits of the surviving spouse.

The amount of survivor benefit payable is 100% of the deceased worker’s full retirement age benefit if death occurs on or before full retirement age and the surviving spouse is at least full retirement age. If the deceased worker earned delayed retirement credits, the surviving spouse’s benefit will be based on the higher amount. At age 60 the minimum benefit for a surviving spouse with an FRA of 66 would be 71.5% of the full retirement age benefit.

A worker need not be receiving Social Security in order for survivors to be eligible for benefits.

Know How Benefits May Be Taxed

Social Security may be subject to income tax. Depending on income levels and tax filing status, most (85%), some (50%) or none of the Social Security benefits will be taxable. Benefits are taxed at the marginal income tax rate of the person receiving them.

Know How Benefits May Be Reduced

If you are younger than full retirement age and earn more than certain amounts, your benefits may be reduced.

- $1 in benefits is lost for every $2 earned in excess of an annual earned income threshold amount. For the year of full retirement age, $1 in benefits is lost for every $3 earned in excess of a higher threshold. Beginning in the month of full retirement age, a person can earn an unlimited amount with no reduction in Social Security benefits.

- Earned income is from working (salary, wages, commission, etc.). Interest earnings, capital gains, pension and annuity income are considered unearned income and will not cause a reduction of benefits.

- Benefits withheld before full retirement age are recaptured starting at full retirement age, resulting in higher monthly benefits later.

Know How Claiming Strategies Work

Social Security does not provide benefits automatically. You must file to receive them.

- For worker or spousal retirement benefits, file three months before you want them to start.

- Survivors currently eligible for benefits should file in the month of death.

- Survivors currently ineligible for benefits should file three months before turning age 60 or at retirement, if later.

Consider Some Claiming Strategies

Delay Filing

Delay Filing

For maximum benefits, delay until age 70. The chart shows how much more you receive.

Suspend

If a worker filed for benefits before full retirement age but continues to work, it may be advantageous to suspend benefits at full retirement age. Suspending allows the worker to continue to earn additional benefit increases up to age 70, based on the suspended amount. For workers who suspend after April 2016, all benefits, including spousal and family benefits, will be suspended.

File at Different Times

Working couples may find it advantageous for the lower earner to take Social Security at age 62 while the higher earner continues to work until age 70.

File Early

Consider filing early if health is a factor. Having an income could be more important than maximizing benefits. The earliest age at which retirement benefits can be claimed is 62.

Know Social Security Itself May Not Be Enough

Some combination of other income sources, such as a pension, savings, retirement plans and employment, will likely be needed. Consider IRAs and nonqualified annuities, both deferred and immediate, for lifetime needs. Consider life insurance to enhance survivorship ease and comfort. Your financial representative has the know how to help you maximize your Social Security benefits.

Contact Your Representative for More Social Security Know How.

Three Simple Steps to Estimate Your Benefits

- Go to www.ssa.gov/estimator/. Click on "Estimate your full retirement benefits."

- Enter your full name, Social Security number, birth date; mother's maiden name; and state where you were born. Hit Submit. Enter last year's wages. Hit Submit again. The Retirement Estimator calculates your benefits based on actual earnings history.

- Check the estimates for reduced benefits at age 62, your full benefits at normal retirement age and your maximum benefits at age 70.